News

Starting a new business?

It was a pleasure to be involved in the NNBN startup day recently, talking about how it feels to start a business and how keeping things simple can often be the best way. As with any other cost, controlling your tax exposure is key.

There were plenty of other speakers and topics throughout the day so if you have started or plan to start a business, visit the NNBN Facebook page. The video that I recorded can be found if you click on the image on the right or here.

NIC Threshold change

With the change in the threshold for National Insurance on 6th July 2022, does it have any impact on the optimum Director's salary for tax and NI purposes?

Well, the starting point is a salary of £9,100 as at this level there is no PAYE, Employee's NIC or Employers NIC liability. Typically, a Director would draw this amount as a 'tax free' salary (subject to other income) and then top up their income with dividends at a lower rate. A salary at this level still 'stamps' your state pension record.

However, with the change in the NI threshold it may be sensible to increase the salary amount to £11,908. A single Director company without any employees would be unable to offset the Employers NIC incurred - but, there is a marginal net tax saving if you consider the reduction in corporation tax.

A Director with employees and surplus Employment Allowance to be claimed could not only draw an increased salary and incur no additional tax/NIC cost but also reduce their corporation tax at the same time!

Tax Credit Renewals

HMRC are warning Tax Credit customers to be alert to phone calls, text messages and emails in the run up to the July renewal date.

HMRC will not telephone anyone threatening prosecution or arrest if immediate payments are not made. Claimants should be alert to false claims that their National Insurance number has been used fraudulently, or to emails or texts offering tax rebates or COVID grants.

About 2.1 million Tax Credit customers are expected to renew their annual claims by 31 July 2022.

Customers can renew their tax credits for free via GOV.UK or the HMRC app and are advised to search GOV.UK to get the genuine information and guidance.

Phishing and scams!

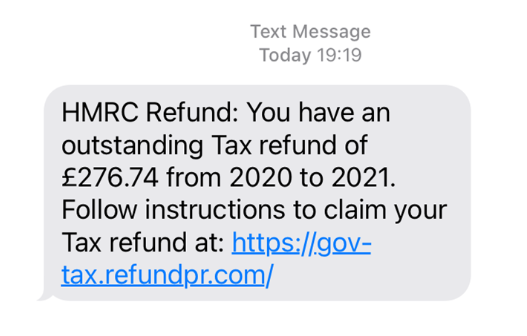

I often get asked by clients whether a text, email or phone call they have received is genuine - particularly where it promises that a tax refund is due.

HMRC have recently updated their guidance, with examples, of what to look out for if there is an attempt at 'phishing' for your financial information.

Currently, attempts may be linked to COVID-19 grants or to an alleged legal case that is in progress against you. You might even now receive a Whats App message.

If you receive anything that you are unsure about, feel free to contact me for a second opinion. Never follow the links or provide any personal information.

DIY Housebuilders

Did you know that if you build your own house or convert a non residential building into a home, you can reclaim the VAT on the building materials?

The DIY Housebuilders Scheme allows individuals to claim VAT on the cost of building materials when building their own home. The intention is to place a DIY housebuilder in a similar position to property developers. The scheme extends to building a non profit communal residence such as a hospice and building a property for a charity.

In order to make a claim, you must include all original invoices; the building regulation completion certificate and evidence of planning permission.

Previously, HMRC policy was that only a single claim for a refund was allowed. However, as a result of a recent case this policy has now changed and where a claim is repaid in error a second claim will be considered if made within three months of the building completion.

Tax free allowances

How much 'tax free' would you like?

Savings allowance - up to £1,000

Property income allowance - £1,000

Trading allowance - £1,000

Marriage allowance - £1,260

Dividend allowance - £2,000

IHT Gift allowance - £3,000

Parental wedding gifts (IHT) - £5,000

Employment allowance - £5,000

Rent a room - £7,500

Capital exempt amount - £12,300

Personal allowance - £12,570

Inheritance tax (IHT) threshold - £325,000 (or more)

How many of the above can you 'tick off' and claim to be making the most of?

Limited company changes

Do you share your business financial information with your friends, competitors and employees? Companies House reform is underway which will mean big changes for small and micro companies who will need to make their profit and loss account publicly available.

In an undetermined timeframe, the following changes will be made:

1. Dormant companies will need to file an eligibility statement.

2. Micro companies will be required to publicly file a profit and loss account.

3. Small companies will be required to file both their profit and loss account and Directors’ report.

If you take into account that one of the definitions of a small company is turnover of less than £10.2m, you get an indication of the number of owner managed businesses that will have to publicly declare their turnover and profit for their friends, competitors and employees to access once these changes take place.

Further reform may also see changes to filing deadlines.

Child Benefit

Do you receive Child Benefit payments and have an income of more than £50,000? If so, you should be aware that you may have to repay some or all of it to HMRC each year.

If your income exceeds £60,000 then all Child Benefit payments received in a tax year need to be repaid. If your income is between £50,000 and £60,000 then a partial repayment will be due on a pro rata basis (1% for each £100 over £50,000).

The charge is paid by the higher earner in a marriage, civil partnership or where two people are living together. It does not matter if the child living with you is not your own child.

There is an online calculator that you can use to check how much you may have to repay.

Corporation Tax - 2023

What will your marginal rate of corporation tax be in 2023? You may be surprised.

If you trade as a limited company and report a profit of between £50,001 and £249,999 you may want to know that your marginal rate of tax in that band is 26.5%.

That’s not 19% or 25% (as widely reported), but 26.5%.

The reason for this is something called ‘marginal relief’ where your tax is calculated at 25% and then an amount calculated by a formula is deducted.

The result is that for every £1 of additional profit in that band, you will pay 26.5% in additional corporation tax. The good news is that with some timely tax planning you can also save 26.5% for every £1 of relief that you can generate!

Plan for 2023!

Working from home?

Do you work from home? Have you considered the additional costs involved and if there might be tax relief available?

You may be able to claim tax relief for heating and light costs, water, telephone and internet based on the additional costs incurred.

You can either claim tax relief at £6 a week from 6 April 2020 (previously £4) without having to keep any evidence of the costs, or, if you want to claim more than £6 a week then you would need invoices, bills, receipts etc to justify the claim on any excess amount. You then receive tax relief on those expenses at your marginal rate of tax.

The employment allowance

Are you an Employer currently paying Class 1 National Insurance (NIC) on top of your employee’s gross pay? Did you know that you might be able to reduce this cost by £5,000?

The employment allowance allows you to reduce your annual Employers NIC cost by up to £5,000 if in the previous year you paid less than £100,000 in secondary Class 1 NIC.

After you make the claim, you just pay less Employers NIC each time you complete your payroll until the £5,000 limit has been reached.

The allowance can be claimed if you are in business or are a charity. This even includes community amateur sports clubs or if you employ a care or support worker.

Furthermore, if you have missed this opportunity in the past then you can reopen the previous four tax years.

Selling a property?

Did you know that the sale of a residential property (that is not your home), at a gain, must now be reported to HMRC within 60 days of the completion date?

The report and payment must be made using HMRC’s digital UK Property Service. If there is no tax to pay then no report is required.

If the report is not made or the tax is not paid within the 60 day period then late filing penalties and interest will be applied, in the same way as for self assessment. The initial fine is £100 with additional penalties after 6 and 12 months. Late payment interest accrues immediately after 60 days.

If you need to report a gain then you will have to create a Capital Gains Tax on UK property account with HMRC, calculate the gain that applies and pay the tax that is due.

The rent a room scheme

Are you thinking about renting a room in your own home?

The Rent a Room Scheme lets you earn up to £7,500 per household, per year, Tax Free from letting out furnished accommodation in your house.

If your income from renting a room is less than £7,500 then you are automatically exempt from tax and you do not need to declare anything. If your income is more than £7,500 then you will need to file a Tax Return each year to claim this relief. You can even use the scheme if you run a guest house or bed and breakfast business, although consideration needs to be given to how suitable this is in comparison to declaring your trading profit.

The key things to remember are that the room/s that you let must be part of your own home, must be furnished and must be in the UK.